We were promised a number of maiden flights in 2023. Unfortunately, only two occurred. That being said, the last 12 months were nonetheless an exciting time for the European launch industry. A number of significant milestones were achieved, and one staggeringly large funding round closed. This should all, hopefully, set Europe up for an exciting 2024 with a few more maiden flights occurring.

Just like last year’s list, this year’s European Spaceflight ranking of European launch companies is subjective. Objective statistics like total launches, success rate, development milestones, and funding were taken into account. However, at the end of the day, a list like this requires a certain amount of subjectivity. The list is also purely on each company’s performance in 2023 and not what they may have achieved in the past or will achieve in the future.

1. ArianeGroup (-)

Love em or hate em, ArianeGroup remains, for now, the dominant force in the European launch industry. The company, through its launch services provider Arianespace, was the only European rocket builder to record any completely successful orbital launch in 2023, deploying Juice in April and the Syracuse 4B and Heinrich Hertz satellites into a geostationary transfer orbit in July. The company has also made significant progress with the development of Ariane 6, which is currently expected to be launched between 15 June and 31 July 2024.

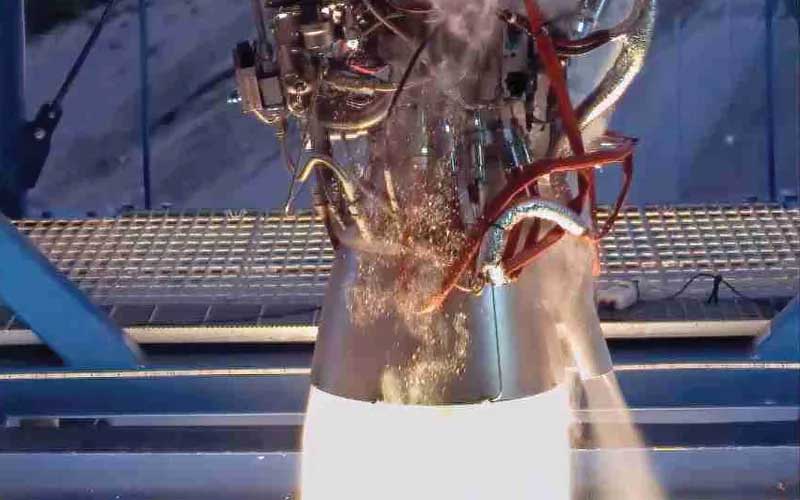

In September, the first full-duration hot fire test of an Ariane 6 second stage was completed. The suitability of the stage for flight did, however, become less certain following a second test in December that was aborted two minutes after ignition. This test was, however, conducted under abnormal degraded conditions to test the limits of the stage and shouldn’t affect the vehicle’s maiden flight.

The last piece of the puzzle was the core stage hot fire test. A successful full-duration test of this final major element of the rocket was completed in November. This gave ArianeGroup the green light to proceed with preparations for the maiden flight while the investigation into the aborted second stage test is ongoing.

Flight versions of the rocket’s major components will be shipped to French Guiana between January and February next year. The components will then be assembled and transported to the pad in late April. While this is happening, the Ariane 6 qualification review will be completed to certify the vehicle as fit for flight.

Another major development for ArianeGroup in 2023 was ESA’s commitment to provide ArianeGroup with €340 million per year to subsidize the operation of Ariane 6. I disagree with this arrangement, but there is no doubt that, from an objective point of view, this is a huge win for the company.

While ArianeGroup’s failure to deliver on Ariane 6 when it said it would resulted in an unprecedented loss of launch capacity for Europe in 2023, the year was nonetheless reasonably successful for the company.

2. PLD Space (+6)

PLD Space has had a big year. The company successfully launched the first flight of its suborbital Miura 1 launch vehicle, making it one of the very few European launch companies to do so in 2023. The launch occurred on 7 October and was conducted at the El Arenosillo Test Centre in Huelva, Spain. The flight lasted a total of 306 seconds, with the vehicle reaching an altitude of 46 kilometres. Aboard the vehicle was an experiment for the German Centre for Applied Technology and Microgravity.

In addition to a successful first flight of Miura 1, PLD Space has also made significant progress on its Miura 5 orbital-class vehicle. According to CEO Raúl Torres, the company is planning component-level testing of its TEPREL-C engine, which will power Miura 5, as early as February next year. Testing of a fully integrated vacuum-optimized TEPREL-C is then expected to commence before the summer of 2024, with testing of the first stage TEPREL-C engine beginning over the summer.

While PLD Space did see an impressive jump in its ranking, the company is unlikely to stay in the top three. With Miura 5 only expected to be launched on a maiden flight in 2025, many companies that missed out on this year’s top five will leapfrog the Spanish startup with planned orbital launch attempts in 2024.

3. Avio (-1)

Avio takes the third spot for no other reason than it conducted a single partially successful orbital launch aboard a Vega rocket. Partially successful because while the two primary payloads, THEOS-2 and TRITON, were deployed successfully, two of ten secondary payloads aboard the flight were not deployed and likely burned up in the atmosphere while still attached to the rocket’s upper stage. This would not be the company’s only failure in 2023. The company also failed a Vega C Zefiro 40 second stage recertification ground test, pushing back the vehicle’s return to flight to late 2024 at the earliest. Then, of course, there is the fact that the company lost two of the last four tanks that were expected to be used for the final flight of Vega in 2024. Although ESA has chosen not to investigate the loss, it is the latest in a long line of incidents that hint at a rapid decline in quality.

Avio’s days at the top of this list are likely numbered. The company has been given hundreds of millions in funding, guaranteed contracts, and apparent immunity to squander public money. They have been allowed these freedoms because they had a monopoly on small launches in Europe. Italy’s large contribution to ESA and the agency’s rules regarding how that funding should benefit the contributing country may also have something to do with it. Regardless, Avio will not have that monopoly for much longer, with MaiaSpace recently revealing that Maia, which is expected to be launched on a maiden flight in 2025, will directly compete with Vega C on launch capacity and very likely at a lower price. While MaiaSpace is the only launch startup to offer a directly comparable launch capacity, other smaller launch vehicles will begin to trickle into the market as early as the first half of 2024. With Vega C likely to only reenter service in late 2024 at the very earliest, Avio will undoubtedly be relying on those three guaranteed yearly flights from European institutions to keep its launch business afloat. Once that deal expires, it’s hard to see a future for Avio that doesn’t include significant changes in leadership and operations.

4. SpaceForest (New)

This one is likely going to be controversial. SpaceForest is working on its suborbital Perun launch vehicle. Perun is a single-stage 11.5-metre guided suborbital rocket powered by a hybrid propulsion system. Once operational, the rocket will be capable of carrying 50-kilogram payloads to a maximum altitude of 150 kilometres.

SpaceForest was not able to complete a successful launch in 2023. However, the company did manage not one but two launch attempts, with the company successfully recovering the vehicle after both flights following midair aborts.

The first flight was conducted on 21 June from the Polish Air Force Central Training Ground in Ustka. The rocket had been expected to reach an altitude of 50 kilometres, but at 22 kilometres an anomaly was detected, and the flight was aborted. Thankfully, the company was able to recover the rocket from the waters of the Baltic Sea to enable another attempt to be made. This second attempt was conducted on 10 October. Unfortunately, 28 seconds into this flight at an altitude of just 10 kilometres, the rocket’s propulsion system failed, forcing the company to abort the mission. The rocket was successfully recovered for a second time.

While two failures aren’t generally indications of a successful year for a launch company, the ability of SpaceForest to turn the vehicle around and make a second attempt in just four months is an impressive feat. This approach of failing often to iterate quickly is one that may sound familiar. The company is, however, likely not expecting a jump in revenue once it gets Perun right, as there isn’t an exploding demand for suborbital research flights. It will be interesting to see if its medium to long-term strategy includes leveraging Perun to develop a larger vehicle that will enable Poland to join the list of nations able to deliver payloads into orbit.

5. Isar Aerospace (+2)

I’ll admit, at the end of last year, I had all but counted Isar Aerospace out. The company appeared to be running dangerously low on funding and had, by all appearances, very little in the way of development progress to show for its record-breaking spending.

In March, both of my concerns about the company were put to rest. Unlike most other launch startups, Isar chose to begin its engine testing in secret. On 23 March, the company finally let the cat out of the bag. Isar announced that it had completed a total of 124 hot fire tests of its Aquila engine over a 12-month period. This represents a significant maturing in the design of the Spectrum’s propulsion system, which is one of the most challenging elements of a new rocket to master. This initial announcement was followed by another in October that revealed that the company had fired one of its Aquila engines for 260 seconds, which is longer than the engine will be expected to perform during a flight. The company also revealed that it had fired a single engine six times without any refurbishment between ignitions and that it had begun manufacturing the engines for Spectrum’s maiden flight.

On 28 March, Isar announced that it had closed a Series C funding round, raising an incredible €155 million. The launch startup has now raised more than €300 million since its founding in 2018. The company explained that the new funding would be used to push ahead with the maiden flight of Spectrum in addition to ramping up production and building the company’s automated production capabilities.

In one final bit of good news from the company in 2023, in November Isar and Andoya Spaceport inaugurated the launch pad that will host the maiden flight of Spectrum. The new spaceport is located in Nordmela on the Norwegian Island of Andoya.

I debated whether or not to bump Isar further up this list. With the progress the company has made in 2023 and the incredible funding round it managed to close, Isar looks to be in a strong position to not only complete a maiden flight but to continue through to operational flights in the years to come. The only thing the company didn’t manage to do in 2023 was to actually perform a launch, which every company above them in this year’s ranking did manage. It is for that reason and that reason alone that they are not higher on this list.

6. Rocket Factory Augsburg (-1)

Rocket Factory Augsburg didn’t launch hardware in 2023, and although it did secure significant funding, those funding efforts were ultimately eclipsed by its fellow German launch startup, Isar. That is why the company has dropped slightly in this year’s rankings. That all being said, RFA still had an excellent year that has cleared the road for a possible maiden flight of the RFA ONE in the first half of 2024.

RFA kicked off the year with the announcement in January that it had secured exclusive access to the first launch pad to be built at SaxaVord Spaceport in Scotland. The company plans to launch its maiden flight from the launch facility. This is potentially a point of concern. Following an initial rush of activity at SaxaVord, work slowed significantly towards the middle of 2023 with rumors that contractors had not been paid. Work is expected to continue at pace in 2024, but with RFA relying on the timely completion of the necessary infrastructure at the site to conduct its maiden flight, any additional construction delays would be a blow to the company’s efforts. To aid in ensuring that this is not the case, RFA secured £3.5 million in UK Space Agency funding to “develop and operate the infrastructure and test equipment needed to enable them to launch from SaxaVord Spaceport” by the second quarter of 2024. Let’s hope it’s enough.

Staying on the topic of launch facilities, 2023 also saw RFA sign a binding term sheet with CNES to access a new commercial launch facility being built at the Guiana Space Center in French Guiana. The facility is expected to be ready for use by 2025. The company has also begun to expand its testing capability. In November, RFA signed an agreement with DLR to conduct engine testing at the German space agency’s Lampoldshausen facility. Testing at the facility is expected to begin in early 2024.

The most significant developments for RFA in 2023 were, however, the successful completion of the Integrated System Test campaign for the RFA ONE second stage in June and the that it had secured a €30 million investment from KKR in August.

In addition to its progress on its launch service, in 2023, the company also announced plans to expand its offering with the Eva service and Argo space station resupply spacecraft. While I think diversifying its offering will benefit the company in the long run, I am concerned that in the short term, it may pull resources away from its core business, which will put its near-term survivability at risk.

7. HyImpulse (-3)

As far as I can tell, HyImpulse should have launched its first SR75 flight this year. It appears that SaxaVord simply was not ready to host the launch, with the company now moving to Australia to debut its suborbital launch vehicle in 2024. Had HyImpulse managed to conduct a maiden flight, it may well have retained its position in the rankings or even improved. However, without it, the company’s progress in 2023 wasn’t as impressive as those that leapfrogged it.

In early September, the company announced its most significant achievement from 2023, revealing that it had successfully qualified its HyPLOX-75 hybrid rocket motors for flight. The announcement came after the completion of the company’s ninth hot fire test, which was the second in less than six months. The motor is powered by liquid oxygen and what the company refers to as “space-grade candle wax.”

In early December, HyImpulse got a slight funding boost, securing €6.5 million in funding from the UK Space Agency and the German space agency DLR. Also in December, the company confirmed, following a question from European Spaceflight, that the height of its SL1 launch vehicle had grown from 27 to 30 metres.

The company also secured a launch licence from the UK Civil Aviation Authority for its maiden SR75 flight. However, since the maiden flight will now be conducted in Australia, the CAA licence is no longer necessary.

HyImpulse won’t launch its first SR75 flight until 2024, and while the exact extent of the company’s financial resources is not clear, it’s likely it isn’t flush with cash. Had the company launched a successful maiden flight of the SR75 in 2023, leaving it free to move forward quickly with its orbital-class SL1 vehicle, then it likely would have been in a good position moving into 2024. However, with this flight now delayed, the company is falling further and further behind other European launch startups that will be aiming to launch maiden orbital flights in 2024 and 2025. This may well be misplaced skepticism, but HyImpulse appears to have a tough road ahead of it.

8. MaiaSpace (+2)

MaiaSpace was founded in early 2022 and is aiming to launch a maiden flight of its two-stage Maia vehicle by 2025. This timeline isn’t quite as ambitious as it sounds because a lot of the vehicle’s development has been completed as part of the work ArianeGroup is doing on its ESA Prometheus and Themis projects. However, the company still can’t be hanging about as that targeted launch date approaches. In 2023, MaiaSpace certainly appeared to be on schedule to meet the challenge of the 2025 debut of Maia.

In total, ArianeGroup invested an additional €33 million into MaiaSpace in 2023. The launch startup’s parent company invested €6 million in late January. This was then followed up with a €27 million investment that was completed in June. In 2022, ArianeGroup had stated that while initial seed funding would come from ArianeGroup, it would begin sourcing private funding from the fourth quarter of that year. If efforts to secure private funding were made, they didn’t produce any results in 2023. Instead, ArianeGroup has stepped in with a not-insignificant investment to ensure the company can continue at breakneck speed. This investment is, however, a hard pill to swallow when ArianeGroup has its other hand out for yearly subsidies financed from public coffers to operate Ariane 6. It would be nice to see MaiaSpace rely less on its parent company for funding in 2024.

Although not directly attributable to MaiaSpace, the first successful hot fire test of a Prometheus engine was conducted in June. Maia will utilize three Prometheus engines to power its first stage and a single vacuum-optimized Prometheus engine to power its second stage. This initial hot fire test lasted for 12 seconds and was followed by a 30-second test in October.

In September, the company completed the first and second cryogenic tests of a full-scale prototype of Maia’s second stage. The company also confirmed that it was in the process of producing a second full-scale prototype that it would use for integrated hot fire testing, which it expects to begin next year.

The final development milestone completed by MaiaSpace in 2023 was the successful first hot fire test of the engine that will power the company’s Colibri kick stage. The kick stage will equip Maia with additional performance and greater flexibility. The company confirmed that the kick stage would enable Maia to increase its maximum payload capacity from 1,500 to 2,500 kilograms to low Earth orbit when launched in an expendable configuration. This puts the vehicle’s performance well into the realm of the Avio Vega C launch vehicle. With Maia’s four Prometheus engines expected to cost a combined €4 million when production is in full swing, it’s not hard to see a scenario in which MaiaSpace will be able to drastically undercut the cost of Vega C, which is expected to run a customer around €45 million a flight.

9. Latitude (-)

Latitude didn’t have a blowout year. That’s not to say the company didn’t have a successful 2023, though. The company spent the year building for the future. It was about setting the foundation for a unique approach to cost reduction through huge production numbers instead of reuse. Latitude isn’t the only company pursuing this approach. Isar is also looking to reduce costs through bulk, automated production. However, Latitude’s targeted production numbers are unique. Will there be a market for 50 upgraded Zephyr rockets per year? Certainly not in the near or medium term. If, however, the company can build an industrial base that allows it to reach those numbers in the long term, it may just have a place in the future of Europe’s access to space.

Although the company didn’t have a flashy year, it did start 2023 in a fiery fashion, completing an important milestone. It conducted a hot fire test campaign of its Navier engine on the island of Unst off the coast of Scotland. The longest of several hot fire tests lasted for 35 seconds.

In line with building for its future, one of Latitude’s most significant accomplishments for 2023 was doubling its factory floor space and appointing Isabelle Valentin as the company’s new chief operating officer. Valentin’s mission will be to prepare the company to “mass produce Zephyr on time, on cost, and on quality.”

The current iteration of Zephyr will be capable of delivering 100-kilogram payloads to low Earth orbit. This version of the rocket is expected to be introduced in 2025. In December 2023, Latitude announced that this payload capacity would be doubled with the introduction of an upgraded variant of the rocket. The company began pursuing this new variant of its launch vehicle after gathering “technical, industrial, and commercial feedback in 2023.” This upgraded version of Zephyr is expected to be launched for the first time in 2028.

10. Orbex (-4)

Orbex isn’t just building a rocket. The company is also building a launch facility to host up to 12 rocket launches per year. On the one hand, it allows the company to create a facility tailored to its needs while also enabling it to control operational costs. However, it also requires massive capital investment that pulls financial resources away from the development of Prime. It’s a risk, and it’s still unclear if Orbex will come out on top.

The company’s journey to build its own launch facility officially kicked off in May. The company received over £14 million in public funding for the project, with £9 million coming from the Highland and Islands Enterprise and the Scottish Government, £3 million from the Nuclear Decommissioning Authority, and £2.55 million from the UK Space Agency.

In June, Orbex signed an interesting Memorandum of Understanding with Arianespace to “explore possible joint offering for small satellite launch customers.” With the loss of Avio Vega launch vehicles after ESA granted the company permission to split with Arianespace, the launch services provider will be looking for a small launch vehicle to complement Ariane 6. One would think that MaiaSpace would fill this role. The company has, however, not yet stated if it will utilize Arianespace to market its missions or if it intends to do it on its own.

While the company moved ahead with construction on its launch facility, Orbex announced in July that it would be adding 1,500 square metres of factory and office space to its existing 4,750 square metres in Scotland and Denmark.

To end the year, Orbex managed to secure £3.3 million in UK Space Agency funding to conduct “activities to ensure it is environmentally sustainable.” These activities will include the creation of a green propellant plant at the company’s launch facility. Once operational, the plant will produce “clean propane” from plant and vegetable waste.

DLR/Bayern-Chemie – (Honourable mention)

Europe launches a not insignificant number of suborbital research missions each year from launch facilities in Norway and Sweden. All, however, use non-European launch vehicles. These research missions are carried to space aboard Canadian Black Brant IX, Brazilian VSB-30, or US Malemute and Orion rockets. In 2019, DLR kicked off the development of the Red Kite rocket motor, which would be a home-grown alternative for Europe’s sounding rocket needs. The agency selected Bayern-Chemie to design, develop, and produce the one-tonne class solid rocket motor, which can be utilized in a one or two-stage configuration.

In 2023, just four years after the project began, the first rocket powered by a Red Kite motor was launched from Andoya, reaching a target altitude of over 70 kilometres. Now operational, Red Kite will be able to carry payloads of between 200 and 600 kilograms to altitudes of up to 350 kilometres.

Red Kite isn’t a flashy entrant to the launch market. However, it has proved to be an incredibly well-managed project that has delivered a product that will enable Europe to deploy a sovereign capability where one had previously not existed.

POLARIS Spaceplanes (Honourable mention)

POLARIS very nearly made it onto the list. I am still not entirely convinced that it doesn’t deserve to be there. The company had a busy year completing the construction of two separate vehicles and firing its in-house developed aerospike engine for the first time. It has proved that it is willing and able to iterate quickly, ensuring that work on its AURORA multipurpose spaceplane and hypersonic transport system progresses rapidly.

In August, the company began testing its MIRA-Light demonstrator. The 2.5-metre vehicle was equipped with small jet engines and was intended to allow the company to calibrate and test its flight control system and aerodynamics and to train the company’s drone pilots. POLARIS completed the MIRA-Light test campaign in September following the completion of 15 flights and a total calculated flight time of between 35 and 40 minutes.

With the completion of a subscale variant, POLARIS began ground testing of its 4.3-metre MIRA demonstrator in October, with a first flight under jet power occurring in November and lasting for 2.5 minutes. The next MIRA flight, which will likely occur early next year, will be the first to be under the power of the company’s 1kN AS-1 aerospike rocket engine.

POLARIS fired up an AS-1 engine for the first time in November, and by mid-December, the company had completed this initial test campaign. The testing was conducted with a heavier version of the AS-1 engine that was specifically designed to be used for ground testing. The next stage of testing will involve a flight version of the engine. Although the company has not yet made an official announcement confirming it, testing of a flight engine, which is designated AS-1F, has already begun.

Many of the companies on this list are producing very similar solutions. POLARIS continues to capture my attention because they are developing something novel. That and they are doing it on a shoestring budget with a small, passionate team plowing forward quickly. It’s an inspiring story.

Sirius Space Services (Honourable mention)

Sirius Space Services was a very late addition. The company had a relatively quite 2023 but has ended the year with a significant milestone. Just yesterday, the company announced that it had conducted a hot fire test campaign for its STAR-1 engine at the DLR Lampoldshausen facility. The engine was fired for a total of 60 seconds.

Not only is it exciting to have another rocket engine that was developed in Europe being fired for the first time, but it’s impressive that the company has secured a spot at the legendary DLR Lampoldshausen facility. Although the company isn’t the only one on this list to do so, it’s possibly the company earliest in its development process to do so. It’s an interesting vote of confidence.

Those that didn’t make it

The problem with a top 10 list is that you inevitably have to leave someone out. In some cases, like in the instance of Pangea and SmallSpark, who did make it onto last year’s list, companies are just no longer working on a launch vehicle. In other cases, however, the companies simply didn’t make quite as big a splash as those that did make it onto the list. That being said, I will still be keeping my eye on the likes of HyPrSpace and OPUS Aerospace from France and Skyrora and Astraius from the UK.