Ten years ago the European launch market consisted of Arianespace and Avio (which has been around since 1908) with the former managing launch operations for both Vega and Ariane 5. PLD Space was founded in 2011, which is always surprising to rediscover, but the Spanish launch startup was a blip in a market dominated by giants. Today, however, there are more than a dozen launch startups in Europe alone hoping to hobble the giants and claim a piece of the market for themselves.

Eric Berger has already made his attempts at ranking US-based launch companies and I thought I’d give it a go for Europe. Here’s hoping Andrew Jones will jump on the bandwagon and create a similar list for Asia.

Like the original, this list is subjective, although statistics like total launches, success rate, development milestones, and funding were taken into account. Additionally, this list is purely on each company’s success in 2022 and not what they may or may not achieve in the future.

1. ArianeGroup – France/Germany

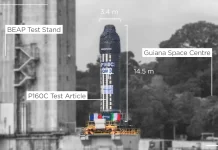

Not a difficult choice here. ArianeGroup, through its launch arm Arianespace, launched three missions in 2022 carrying five geostationary satellites to orbit which together totaled approximately 27,000 kg. The company also completed key testing of its Ariane 6 vehicle which included integrated launch pad testing and a hot fire test of the vehicle’s upper stage.

Coming into 2022, the company had been targeting a maiden launch of its next-gen Ariane 6 vehicle to take place before the end of the year. This, however, was dealt a blow when ESA Director General Josef Aschbacher announced that the debut of Ariane 6 had suffered another delay pushing the maiden flight to late 2023.

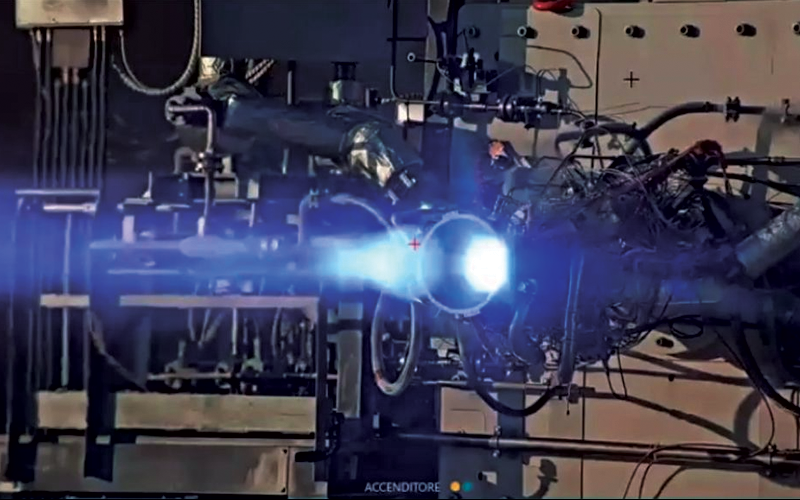

In addition to the trio of launches and Ariane 6 testing milestones conducted by ArianeGroup in 2022, the company also completed the first successful test firing of its Prometheus methlox rocket engine. The engine is the backbone of the company’s push to integrate reusability into future launch systems. This may start with retrofitting Ariane 6 with liquid-fuel boosters that could allow the vehicle to be crew rated. However, at the moment the company is focused on using it for the Themis reusable rocket demonstrator. The engine will also be used aboard the Maia launch vehicle from MaiaSpace, a subsidiary of ArianeGroup launched in early 2022 to compete in the microlauncher category.

2. Avio – Italy

As the only other company to successfully launch a mission in 2022 and the only other European launch company with an operational vehicle, Avio is the obvious second place to ArianeGroup. The company managed to successfully introduce its Vega C launch vehicle to the market in 2022 with a flawless debut in July. However, this success was somewhat marred by the failure of the vehicle’s second flight in December.

In addition to its launch success, Avio also conducted several tests of its M10 methalox upper stage engine this year. The engine is to be used aboard the upper stage of the Vega E, the successor to the current Vega C. The vehicle is expected to make its debut in 2026. The company has also started work on a methalox first stage engine and a demonstration vehicle for which Avio received €340 million in funding in June. Avio closed out the year with a record-breaking contract from the European Commission which ordered five Vega C launches for its Copernicus constellation.

3. Skyrora – United Kingdom

As the only other European launch company to attempt a flight in 2022 Skyrora gets the nod for third place. The company attempted a launch of its suborbital Skylark L vehicle in October. The flight ended in failure with the vehicle crashing into the ocean approximately 500 meters away from the mobile launchpad. This failure was compounded by the loss of the company’s experienced COO Lee Rosen and a damaging Snopes article that examined the shady structure of the business and source of funding.

On the more positive side, the company inaugurated a new engine test facility in Scotland, moved into a larger production facility, which it claimed was the UK’s largest rocket manufacturing facility, and conducted successful testing of the company’s Skyforce engine as well as an integrated hot fire test of the second stage of its Skyrora XL vehicle. Skyrora also applied for a launch licence and signed an agreement with Maritime Launch to launch Skyrora XL missions from Spaceport Nova Scotia in Canada.

4. HyImpulse – Germany

In March HyImpulse rolled out the first SR75 suborbital launch vehicle. Over the course of the year, the company completed several preparatory tests leading up to a maiden flight that the company had hoped to complete before the close of 2022. This, however, was not to be. The company did manage to complete a full wet dress rehearsal which is one of the final steps before its maiden flight.

It’s unclear what is still holding the maiden flight of the SR75 vehicle up but the fact that the company has yet to confirm where the mission will be launched likely has something to do with it. In March, HyImpulse stated that SaxaVord Spaceport in Scotland was a possible launch site for the SR75. Considering the fact that HyImpulse has expanded its presence in the UK in 2022, I would consider this as the front-runner. The launch facility recently received £300,000 in UK Space Agency funding to build a launch rail that will accommodate suborbital vehicles. The company may be waiting to see how quickly this project progresses before making a decision.

The SR75 utilizes HyImpulse’s HyPLOX-75 hybrid rocket motor to carry the rocket to an altitude of 200 km. Clusters of the same hybrid rocket motor will power the first and second stages of the company’s SL1 orbital launch vehicle. A smaller motor based on the same technology will power the upper stage of the SL1. As a result, completing a suborbital mission utilizing the HyPLOX-75 motor will be a significant development milestone for the company.

Additionally, 2022 highlights from HyImpulse included receiving a £399,000 grant from the UK Space Agency to enhance its engine testing capabilities at its Shetland facility, a €2.6 million grant from the Baden-Württemberg municipality to develop a green upper stage along with Astos Solutions, enGits, and the University of Stuttgart, and the signing of launch services agreements with DCUBED and In Orbit Aerospace Inc.

5. Rocket Factory Augsburg (RFA) – Germany

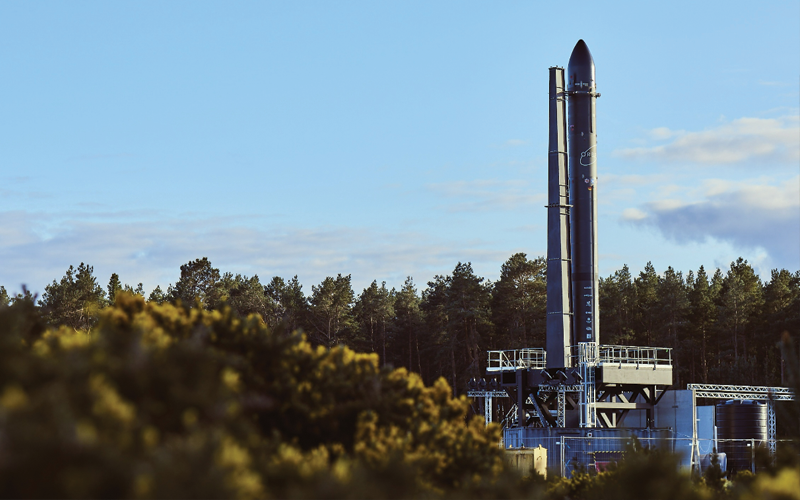

The German launch startup had a successful year in 2022 in terms of development milestones. RFA conducted several successful tests of its Helix rocket engine which culminated in a long-duration test fire campaign. The company also completed the first second stage of its RFA ONE launch vehicle which is currently on a test stand in Sweden awaiting a test firing. RFA had hoped to conduct this test before the close of 2022, but that didn’t come to fruition.

RFA signed several agreements in 2022 including deals with DLR to conduct engine tests at the agency’s Lampoldshausen facility, with Spaceflight to launch its Sherpa OTVs, Digantara to launch its constellation of 40 space situational awareness satellites (the agreement came with a provision that will allow RFA to utilize Digantara’s Space MAP services), and with spaceflight broker Precious Payload to offer the RFA ONE on the company’s Launch.ctrl platform. That last agreement with Previous Payload resulted in the unintentional leaking of the fact that RFA is working on a larger vehicle called the RFA ONE MAX, something that had been rumored but, until that moment, not confirmed.

In April, RFA also won a second and final leg of a DLR microlauncher competition that awarded €11 million. The award came with a requirement to carry 150 kg worth of institutional payloads aboard the first two RFA ONE flights for free. Isar Aerospace won the first leg of the competition with HyImpulse being the only company competing not to win.

RFA also founded a subsidiary Rocket Factory LTD in Scotland in November. With other announcements teasing the company utilizing a launch facility in the UK, the presence of its new subsidiary in Scotland likely indicates that RFA will utilize SaxaVord for RFA ONE launches. The company also signed an agreement with Southern Launch to conduct RFA ONE launches from the company’s Whalers Way Orbital Launch Complex in South Australia.

6. Orbex – United Kingdom

Orbex had what you could probably call a breakout year in 2022 becoming the first European launch startup to secure Series C funding and taking over the construction of a high-profile launch facility project.

The most notable of its achievements in 2022 is without doubt the £40.4 million in Series C funding it secured bringing its total funding to €114 million. This is significant because the company now has sufficient funding to complete the development of its Prime launch vehicle, including the maiden flight and likely beyond. No other European launch startup can currently claim this milestone. The only reason Orbex loses out to RFA in the ranking is that they’re not yet beginning integrated stage testing of Prime’s propulsion system – it was a tough call and on another day I may have bumped them ahead of RFA.

The other significant event from Orbex in 2022 was the announcement that the company would be taking over the construction Space Hub Sutherland in Forres, Scotland. The company will utilize the facility as the home base of its Prime launch vehicle customizing the facility and its operations to its needs. In order to manage the construction project, the company has turned to Jacobs who is not only NASA’s largest services provider but also an investor in Orbex.

Earlier in the year, Orbex submitted its application to the UK’s Civil Aviation Authority for a launch licence, unveiled its first fully-stacked prototype of Prime that the company utilized for integration and procedure testing, and, along with Force Technology, won an ESA contract to develop advanced rocket engine testing utilizing a new x-ray inspection system.

7. Isar Aerospace – Germany

Isar is in an awkward position. On the one hand, the company has secured more funding than any other European launch startup and has continued to grow its launch manifest with multiple launch services contracts already under its belt. However, Isar has also struggled to show any development progress and ended 2022 with a fairing separation test being the company’s only publicized development milestone. Many other startups with far less funding and smaller staff counts have already made significant progress with engine testing, something Isar is yet to begin. As a result, Isar could very easily have fallen further down this list and is saved only by an impressive list of launch services contracts. However, these contracts aren’t going to mean anything unless Isar can find a way to deliver on them.

Despite my skepticism, Isar did kick off 2022 on a high note winning the European Commission’s EIC Horizon Prize “Low-Cost Space Launch” for which it received €10 million. I would be very interested to see the criteria and eventually scoring against that criteria that netted Isar this award. In addition to the European Commission award, Isar’s highlights from 2022 included signing a multi-launch contract with Exotrail and a launch contract with D-Orbit to SSO from Andøya in Norway. Isar also hired David Kownator as CFO in 2022. As part of the announcement on LinkedIn, the company touted Kownator’s experience with large-scale fundraising hinting that Isar is pursuing a new large funding round.

Unfortunately, there were also setbacks. In February 2022, a loud bang was heard coming from an Isar test facility on a rural property in the Kohlberg district of Reischaback, Germany. A statement from Isar following the incident confirmed that “an incident” had occurred in the operation of one of its test benches. The company was required to shut the facility down until it could submit a report along with a proposal for corrective measures to local authorities. This left the facility shut until late July. This delay has likely bled into the company’s engine development timeline which is still working towards the first test firing of Isar’s Aquila rocket engine, which will be utilized aboard the first and second stages of Spectrum. This is probably my key determining factor for Isar’s poor performance on this list. Every other company above it has managed to either launch a vehicle or at least successfully develop and test one or multiple rocket engines, which is typically the most labor-intensive element of developing a launch vehicle.

As the company continues to struggle with the development of Spectrum, the burgeoning staff count, which now likely exceeds 200, continues to burn through Isar’s runway. As a result, the company will need to secure a new funding round soon, something it failed to do in 2022, which is the first year the company has failed to secure new funding since its founding in 2018. Kownator will have his work cut out for him in 2023 to ensure Isar secures a large enough new funding round to complete the development of Spectrum while avoiding a down round which would affect Isar’s valuation.

Interestingly but not really relevant to its ranking, Isar also founded a subsidiary in France in 2022 with its head office in Villecerf, which is about 80 kilometres south of Paris. The subsidiary’s primary activities relate to “research and development.”

8. PLD Space – Spain

Much of the work completed by PLD Space in 2022 revolved around preparations for the maiden flight of its Miura 1 suborbital launch vehicle. The company fully stacked the vehicle and completed several hot fire tests that culminated in a 122-second full-duration hot fire test in September. PLD Space also completed functional tests on the Miura 1 launchpad hold-down system in early December. The company’s testing did suffer a hiccup in June after a full-duration hot fire test had to be aborted after an anomaly was detected during the countdown.

Although PLD Space’s preparation for the maiden flight of its suborbital launch vehicle is likely more advanced than many above it, they lose out because the TEPREL-B engine that will be used aboard Miura 1 is only a stepping stone to the TEPREL-C engine utilized aboard its Miura 5 orbital launch vehicle. Although a flight of Miura 1 will certainly validate some key systems and be a significant milestone for the development of its engines, Miura 5 will be a much larger step forward than that of HyImpulse’s SR75 to SL1 launch vehicles.

PLD Space also signed an interesting agreement with Spanish energy company Repsol in 2022 to develop new renewable fuels. The new fuels will be used aboard the company’s Miura launch vehicles. The pair aim to reduce the carbon footprint of the Miura launch vehicles by up to 90%.

9. Latitude – France

Latitude began its year by announcing that it would be launching its Zephyr launch vehicle from SaxaVord in Scotland. The company revealed that it plans to begin launching from the facility in 2024.

In March, Latitude tapped Saturne Technology to 3D print its Navier engines. Saturne has already produced several engines for Latitude since the deal was concluded, one of which became the first Navier Mark 1 engine to be ignited just before Christmas, or so the evidence would have us believe. The video shared by the company’s CEO on 23 December cuts out just before ignition leaving us wanting more. We’re still waiting for the extended video of the hot fire test.

The other significant milestone of Latitude’s year was the closure of a €10 million Series A funding round in June. The round was led by Crédit Mutuel Innovation and Expansion with participation from BPI, Comat, Nicomatic, and ADF. With the announcement of its Series A funding round, the company also announced its rebranding from Venture Orbital Systems to Latitude. This is the second time the company has been rebranded with it being founded under the name Prometheus Space Industries in 2019.

In addition to its Series A funding, Latitude also received funding from the French government as part of the France 2030 mini and micro launchers call. A breakdown of the exact figures each company received was not shared. A total of 15 projects received a share of €65 million in funding. According to a source, the majority of that funding went to a CNES project to convert the old Guiana Space Centre Diamant launch facility into a multi-use commercial launch facility. As a result, the individual awards to the four launch companies that received France 2030 funding were likely in the region of €500,000 to €1 million each.

The company also signed a memorandum of understanding with Flying Whales, a French startup developing large rigid airships capable of carrying 60-ton payloads at speeds up to 100km/h. Latitude intends to utilize the airships to transport Zephyr stages from its production facilities in France across the English Channel to its launch facility in Scotland.

10. MaiaSpace – France

Since it was founded less than a year ago, MaiaSpace may be a controversial pick this high up on the raking. However, the company’s age has very little to do with its development progress thanks to its parent company ArianeGroup.

MaiaSpace will be utilizing the Prometheus methlox rocket engine being developed by ArianeGroup. The team will also lean heavily on the work done for the Themis demonstrator for other major components of the vehicle. Additionally, much of the core team is made up of ex-ArianeWorks employees, a now-discontinued skunkworks division of ArianeGroup that spearheaded the development of Prometheus and Themis. This pool of talent along with an aggressive recruitment strategy and seed funding from its parent company has allowed MaiaSpace to grow to close to 30 employees within 12 months. With the technology and the experience already onboard, MaiaSpace has managed to leapfrog many competitors that have been at it for far longer.

Another notable element of the MaiaSpace strategy is the company’s drive to develop a reusable vehicle from the onset. Many other companies on this list do have plans for reusability once they have managed to bring an operational vehicle to market. MaiaSpace is, however, unique in the fact that reusability is a core tenant of its design philosophy and not a “nice to have.” The company’s reusability efforts do, however, prove the extreme cost these small vehicles have to pay in order to be reusable. Maia will be capable of delivering 1,500 kg payloads to orbit when launched in an expendable configuration and just 500 kg when it is to be recovered and reused.

11. HyPrSpace – France

HyPrSpace announced in April that it had raised €1.1 million in Seed funding. However, by July when it announced its new Vice President of Programs, the company stated that the funding was a Series A round. Either way, the funding round was led Bpifrance and included contributions from “private investors.” It allowed the company to accelerate the development of its OB-1 (with OB standing for Orbital Baguette) reusable launch vehicle.

In addition to its Seed/Series A funding round, HyPrSpace also, like Latitude, received funding from the French government as part of the France 2030 mini and micro launchers call.

In September, HyPrSpace announced the successful maiden hot fire test of its Joker MK2 hybrid engine equipped with an aerospike nozzle. The announcement was, however, not without controversy. The image of the test posted by the company appeared to show an unsecured N20 cylinder a little too close to the test bench. The company’s response wasn’t exactly coordinated leading to a bit of a PR headache for HyPrSpace.

12. SmallSpark Space Systems – United Kingdom

I debated slotting SmallSpark higher on this list but decided not to purely because SmallSpark hasn’t developed its launch vehicle as far as others. However, the company has diversified its offering much more than any other European launch startup allowing it to generate income long before its competitors.

In 2022, SmallSpark received a £292,565.75 contract from the UK Ministry of Defence via its Defence and Security Accelerator to utilize its moore.AI technology to accelerate the time it takes to develop novel solid rocket motor configurations. Unlike most other contracts mentioned in this article, SmallSpark is able to already begin delivering on its requirements ensuring some cash flow is coming in while it develops other products.

SmallSpark also announced its S4-SLV lunar transfer service in 2022. The service will utilize an orbital transfer vehicle to deliver small satellites to lunar orbit. The company hopes to bypass an already saturated Earth orbit OTV market by creating a road to the Moon for a market that does not yet exist. This is certainly a risk but if it’s successful, SmallSpark could find itself on the ground floor of a lucrative new market. The company expects to launch its first S4-SLV mission in 2024. The company also received £76,000 in UK Space Agency funding in 2022 that will be used to develop the NEWT-A2 propulsion systems that will be utilized aboard the S4-SLV vehicle.

During the last 12 months, SmallSpark was also accepted into the ESA Business Incubation Centre in the United Kingdom to accelerate the development of its suborbital Frost Micro launch vehicle. The maiden flight of Frost Micro is expected in 2023.

Interestingly, SmallSpark also announced its FLOWCAST solution in 2022. According to a LinkedIn post, the solution was meant to accelerate the solving of high-variable, complex optimization challenges. Although this post is still up, all reference to it on the SmallSpark website apart from a title of a PR post has been stripped out. I initially thought that it had become more.AI but the branding and posting timeline doesn’t seem to support this assertion. It’s unclear what happened to this offering or if or when SmallSpark still plans to introduce it.

13. Sidereus Space Dynamics – Italy

I still think what Sidereus Space Dynamics are aiming to do is a little insane. The company is marketing its single-stage-to-obit EOS launch vehicle as “the personal computer of launch vehicles.” The 3.5-metre tall vehicle is designed to be capable of deploying 13 kg payloads to LEO, reentering the atmosphere, and touching down propulsively all with minimal launch infrastructure. There is also a bit on the website about the vehicle capable of recovering and returning payloads from orbit, which is again fantastical.

However, despite my skepticism, the little Italian launch startup seems to be steaming ahead managing to secure launch contracts, conduct structural testing, and even complete a rather shaky-looking engine test in 2022. If I wasn’t so skeptical about the company’s ability to pull its concept off, Sidereus may very well have ranked higher on this list.

Going back to those launch contracts, Sidereus Space Dynamics signed a launch contract with satellite manufacturer Delta Space Leonis to validate the company’s first deployer with five pocketqube satellites for IoT applications aboard EOS. This was followed by a contract with IoT connectivity startup Cshark in November to deploy the company’s constellation of picosats. Finally, in December, the company signed an agreement with EXPLOORE Aerospace Cluster to offer orbital access and return services for testing, validation, and space qualification of new components.

The company closed off the year by opening its new facility in the Amalfi Coast region of Italy. It is also currently hiring aggressively and is on the lookout for candidates on both the engineering and non-engineering sides of the business.

14. Pangea Aerospace – Spain

Spain’s Pangea Aerospace had a fairly quiet 2022 that focused on outlining its future rather than making significant technical and commercial progress.

In September, the company unveiled its new website along with an updated Meso rocket design and the introduction of its 300 kN methalox aerospike engine called ARCOS. The new design for Meso ditched the novel shape of the past for a more traditional rocket design while retaining the aerospike engine. The vehicle’s capacity was also increased from 150 kg to 400 kg to low Earth orbit. ARCOS was introduced as the main engine of Meso and is expected to be the first of a larger portfolio of rocket propulsion solutions that will be offered to other rocket builders.

October saw the only significant development milestone of the year with Pangea completing a preliminary design review of both the oxidizer and fuel turbopump systems for ARCOS.

Finally, Pangea managed to get some assistance with the development of ARCOS with ESA agreeing in October to provide support for the company’s ITAN project which aims to develop, manufacture, and test two types of 3D-printed injectors for its engines.

The above is by no means an exhaustive list of European launch companies. Some other notable companies that had fairly quiet years in 2022 are Opus Aerospace, Dark, and Sirius Space from France and B2Space from the United Kingdom. Each of these companies has raised funding and has shown developmental progress with their respective solutions. As a result, it would be a mistake to completely discount any of them.