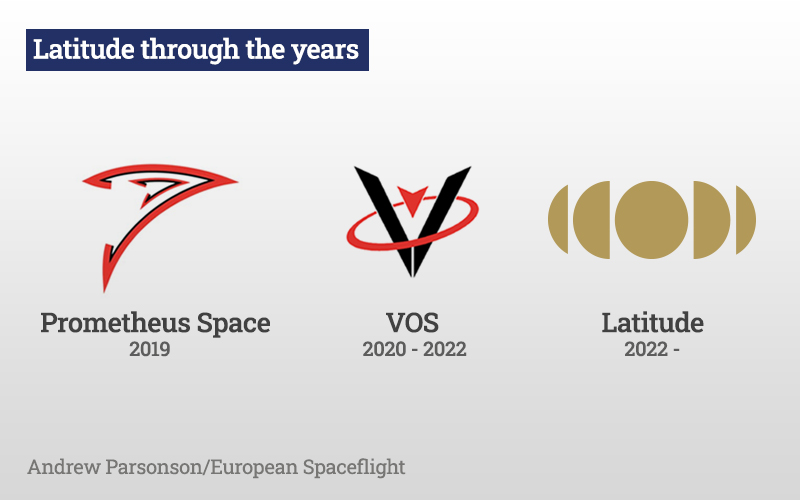

Latitude was officially founded in 2019 by Stanislas Maximin, Ilan Saidi-Bekerman, and Corentin Coste. However, at that time it was not called Latitude or even Venture Orbital Systems for that matter. According to the French company registry, Latitude started life as Prometheus Space Industries with approximately €25,000. The new company was registered in Nanterre but the actual business of preparing to build rockets was done in office space in Paris.

Very little reference to that original company remains. All I could find was a Tweet from Stanislas Maximin describing the company as a “French New Space startup developing cutting-edge technologies to serve the CubeSat market” and the company’s logo on a The Space List entry.

The company’s actual beginnings do, however, predate its original founding. Stanislas Maximin began working on the project in April 2018 when he was just 19.

Although not featured on the company’s founding paperwork, Kevin Monvoisin is the company’s fourth co-founder. According to Monvoisin’s LinkedIn page, he joined the company as co-founder and chief technology officer (CTO) in April 2019 bringing some much-needed experience to a very young founding team (both Stanislas and Ilan were just 20). According to Stanislas Maximin, despite Corentin Coste stating on his LinkedIn page that he served as the company’s CTO from September 2018 to June 2020, he instead shared some of the role’s responsibilities with Kevin Monvoisin holding the role in an official capacity.

Corentin Coste left Latitude in June 2020. According to Stanislas Maximin, his departure was due to “personal reasons.” Before he left, his share of the company was bought back. I asked what had happened to that share of Latitude, but Stanislas Maximin declined to let those details slip

Needless to say, the beginnings of Latitude were a little messy. In 2020, however, the company had dealt with its teething problems, changed its name to Venture Orbital Systems, moved from Nanterre to Reims, and, to close off the year, secured €750,000 in seed funding.

Side note: There’s a story behind the name change from Prometheus Space Industries to Venture Orbital Systems that I will eventually find at the bottom of a bottle of champagne that will make a great chapter of a book someday.

The evolution of Zephyr

Thanks to a combination of some old tweets and Wayback Machine snapshots, we know that an early Zephyr design stood at 11 metres tall and was capable of carrying just 40 kg payloads to low Earth orbit (LEO). This version of the rocket was, however, referred to internally as version 2.1, so there are definitely at least two iterations before it.

By August 2020, the rocket had grown to 12 metres with a diameter of 1 metre and was now capable of carrying 80 kg payloads to LEO. The rocket had also lost a first stage engine, going from seven Navier Mk1 engines to just six. At the time, the company explained that the reason for the change was a nearly two-fold improvement in thrust from the Navier engines. This variant of the rocket was referred to as version 2.4.

In early 2021 the rocket again grew, going from 12 to 15 metres with a new diameter of 1.2 metres. The payload capacity remained the same from the version 2.4 variant. Around this time, the company also introduced Boreal, a suborbital technology demonstrator that was expected to debut in 2023. This concept was, however, quickly abandoned, with the company selecting to focus all its effort on developing Zephyr.

The latest version of Zephyr, which is referred to internally as ZF001 (the “ZF” stand for Zephyr Flight) was announced with the company’s Series A and rebranding announcement in June 2022. The rocket now stands at 17 metres tall while retaining its 1.2-metre diameter, and is constructed from composite materials. All cryogenic elements of the rocket are, however, built out of aluminium.

The rocket’s first stage also makes space for three additional Navier engines for a total of nine, all of which are the upgraded Mk2 variant. According to Stanislas Maximin this change allows the company to lower the max thrust of the engines which assists with mass production, reliability, and performance. The second stage features a single vacuum-optimized Navier Mk2 engine.

This current version of Zephyr is capable of deploying 100 kg payloads to SSO at an altitude of 700 kilometres, despite the Latitude website stating otherwise. This is particularly interesting considering that Stanislas Maximin Tweeted in December 2020 that there was “no market for 100-150kg.” To save Stanislas from a Peter Beck eating his hat moment, he stressed that the market has changed significantly since then and that the company’s design and assumptions about the needs of its customers had evolved with it.

The maiden flight for Zephyr is currently targeted for 2024 from SaxaVord Spaceport in Scotland. Interestingly, this target hasn’t changed since at least December 2020. Considering how much the vehicle has evolved since then, it’s certainly ambitious.

In addition to SaxaVord, Latitude is also one of seven companies to be pre-selected by CNES to launch from a new commercial launch facility at the Guiana Space Center. The new facility will be built on the ground of the old Diamant launch facility that was utilized between 1970 and 1975.

When Zephyr is fully operational, Latitude has envisioned being able to launch at a cadence of one flight per week. That is, surprisingly, not the company’s most ambitious launch cadence target. In February 2021, La Chronique Spatiale reported that the company expected to be launching 20 flights per year by 2026. This would be a staggering achievement just two years after a maiden flight. When asked if he could even fill 20 flights a year, Stanislas Maximin said that he “expects to have the 20 flights sold by a year from now.”

A final element about the vehicle to note is that in September 2022 Latitude signed an agreement with Flying Wales to utilize rigid airships to transport Zephyr stages to Scotland for launch. This sounds incredible, but also a little fanciful. I definitely stand to be corrected, but transporting rocket stages via an airship to the very windy tips of Scotland does sound challenging. This is not even mentioning the fact that Flying Whales is itself a startup and that they have yet to actually build one of their LCA60T airships. There are many transport planes with more than enough capacity for the small Zephyr stages that would be far more practical. According to Stanislas Maximin, the primary option for transporting Zephyr stages to the launch facility is trucks.

Propulsion

Latitude has not shared many details about their Navier engines. What we do know is that they will be fully 3D-printed and powered by a LOX/RP-1 bipropellant.

According to a December 2020 Les Echos article, the company initially tapped Lisi Aerospace to produce the engines. However, Latitude ultimately decided that the product produced was not priced competitively and did not meet the company’s expectations.

After parting ways with Lisi Aerospace, Latitude tapped Saturne Technology to produce its engines. According to Stanislas Maximin, the company has already produced several engines, including the first Navier Mk1 engine that will be hot fire tested. This test campaign is expected to commence before the end of the year.

The Mk1 is, however, only a stepping stone on the company’s road to the launchpad. The first flight version of Zephyr will utilize the upgraded Mk2 engine, which is only expected after testing of the initial prototype is complete.

The Navier MK2 engines will utalise electrical propellant pumps developed by Orbital Machines.

The Norwegian company is itself a startup, having been founded in 2018. To date, the company has raised €300,000 and, in addition to Latitude, is developing propellant pumps for the crowd-funded crewed launch program Copenhagen Suborbitals and their Spica rocket. According to a July 4 post from Orbital Machines, the oxidizer CAD-design for the Zephyr propellant pump has passed a final design review, with the company moving on to manufacture the first prototype.

Testing of the Navier engines will be completed at ArianeGroup’s facilities in Vernon. This unlikely agreement will see Latitude testing the first iteration of its Navier engine before the end of this year.

Financials

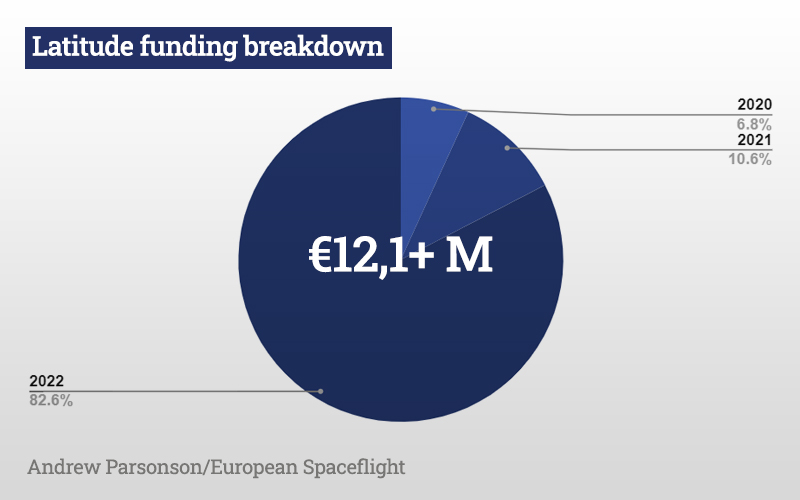

By the end of 2021 Latitude had a burn rate of approximately €115,000 a month with a staff of around 30. With approximately €204,000 in cash on hand, the company was left with a rather short runway moving into 2022. Luckily, Latitude managed to secure its €10-million Series A by June 2022.

Since the beginning of 2022, Latitude has been on an aggressive hiring run, adding an additional 40 members to the team for a total staff complement of around 70 people. This likely pushes up their burn rate to well over €210,000 a month on the increase in salaries alone. With all the other expenses added, Latitude’s burn rate is likely significantly higher than that. Similar launch companies of comparable size and development progress have burn rates of between €400,000 and €500,000 a month.

Interestingly, after a thorough review of the LinkedIn profiles of Latitude employees, it appears that the company hired no fewer than 19 of its new staff members between January and June 2022 before the Series A announcement. That’s a more than 60 increase in the total size of the company in six months, at a time when they didn’t appear to have very much money on hand. This would indicate that Latitude was pretty certain that their Series A funding round was going to be favourable. This is not really that surprising, since many of its investors returned for the Series A funding round.

This section was completed with a lot of help, patience, and understanding from my amazing partners at Capitol Momentum.

Funding

On 2 June 2020, Latitude was accepted into the ESA Business Incubation Centre Nord and received €25,000. This is the first bit of funding the company received from an external source. This was quickly followed by a €50,000 contract and CNES technical assistance for the development of its Navier rocker engine as part of R&D Pitch Day Challenge in late June 2020.

In December 2020 the company got its first real money receiving €750,000 in seed funding from UI Investissement through its IRPAC Création fund, a “business angel”, the PIA 3 scheme (State and Grand Est Region), and Bpifrance. The funding was expected to accelerate the design of the launcher by recruiting 11 engineers already associated with the project and filling five new roles by the end of 2021.

In January 2021, Latitude l was accepted into the Région Grand Est’s Scal’E-nov accelerator programme. Acceptance into the programme came with a loan of up to €150,000 to accelerate the company’s development, and a grant of €30,000 to recruit a business development manager.

In May 2021, Latitude announced that it had received a €100,000 grant as part of the Grand Est region’s “Aid for the first developments of the Start-Up” scheme. The grant was specifically awarded to aid the company with the development of Zephyr’s aluminum cryogenic tanks.

In June 2021, Latitude received €1 million in additional seed funding. This additional funding round has previously not been publicly shared by Latitude. The round included Space Venture Investors from the UK in addition to other unnamed investors. Interestingly, Space Venture Investors has already invested in Orbital Machines, the company producing propellant pumps for Latitude.

The first major injection of capital came in June 2022 with the announcement that Latitude had closed a €10 million Series A funding round. The round was led by Crédit Mutuel Innovation and Expansion with participation from Bpifrance, UI Investissement, Comat, Nicomatic, and ADF. The funding was to be utilised to accelerate the development of the company’s Navier rocket engine. It was also to be used to continue the development of the rocket’s tanks, structures, fairing, and onboard electronics and software.

This largest round of funding was the first to prompt Latitude to issue new shares. From June to September of this year, the company issued new shares three times. The first of the three represents 0.5% of the company and therefore is not all that significant. On 26 July, however, the company completed a major issuing of new shares to coincide with the Series A funding round. Following the issuing of these shares, the shares of the founders were diluted down to a little over 57% of the company. A final share dilution was filed in September. According to Stanislas Maximin, this most recent share dilution is a small extension of the company’s Series A funding round.

According to a Dealroom estimate, Latitude is valued at €40 to 60 million following the closure of its Series A funding round. However, Capitol Momentum calculates that depending on the makeup of the €10 million in funding (if it was entirely equity or a mix of equity and debt), this estimate is significantly higher than the reality. If the Series A was 100% equity, Capitol Momentum estimates Latitude likely has a valuation of between €20 to 25 million.

In early October, Latitude received funding for its XANTHOS project as part of the space component of the France 2030 initiative. France 2030 seeks to sustainably transform key national sectors through R&D and industrial investment. €1.55B of the total funding has been earmarked for space. The early October announcement revealed 15 projects that received a combined €65 million in funding, one of which was the Latitude XANTHOS project. The unspecified funding received by Latitude will be used to support the development of the company’s Navier MK2 engine.

Subsidiary

Astreos was founded in February 2021 and offers launch brokering services to customers looking to launch cubesats and nanosats. Stanislas is listed as the company’s CEO, but the bulk of the work being done by Astreos is led by COO Clémence Cambourian.

Although I couldn’t find any launch agreements, Astreos does have a deal with Comat to use the company’s deployer for nanosat and cubesat flights. The agreement is part of a deal struck between Comat and Latitude to utilize the deployer aboard Zephyr flights. Until Zephyr moves into operational service, Astreos will make utilize the deployer for brokered flights aboard other vehicles.

Conclusion

Latitude has a lot of political support in France, and that is a valuable commodity for a startup to have. In addition to the political support, the company is flush with Series A cash, filled with new talent, and progressing towards the first test firing of its propulsion system. It still has a long way to go, and I predict that the 2024 maiden launch date will likely slip a year or two at least. The company has also told me that it will require additional funding rounds to get its vehicle to the launchpad for a maiden flight. Its investors, though, many of which have stuck around through multiple financing rounds, seem to be confident that Latitude has what it takes to muscle into what is turning into a very competitive European small launch market.

Keep European Spaceflight Independent

Your donation will help European Spaceflight to continue digging into the stories others miss. Every euro keeps our reporting alive.